Cost Of Insulin Driving 80% Of Diabetic Americans Into Debt: Survey

By Tyler Durden

By Tyler Durden

A new survey finds that the cost of insulin is driving many diabetic Americans to go into debt, forcing them to ration medication as they struggle to pay for other living expenses.

The survey, conducted by CharityRX, found that 79% of respondents said insulin costs had created financial difficulty for them personally, or for those in their care – both with and without health insurance, The Hill reports. 80% of those surveyed said they had to take on credit card debt to afford the drug.

What’s more, on average, diabetic Americans take on $9,000 of debt to cover these costs.

That cost carries serious implications, as 83 percent of respondents indicated they’ve feared not being able to pay for living expenses — such as clothing, food and their rent or mortgage — due to high insulin costs.

The pressure to afford insulin even drove 63 percent of people to consider selling prized personal possessions and 32 percent to consider selling prescriptions or illicit drugs to get the money needed to buy insulin.

More than half of respondents, 62 percent, skipped and/or adjusted their insulin dosage to cut down on costs. -The Hill

“While the pandemic has made this situation worse, insulin rationing is a crisis that has been decades in the making. The price of insulin nearly tripled between 2002 and 2013, and the trend upward has made affording this life-saving medication even more challenging for millions of Americans living with diabetes,” the American Diabetes Association said in a statement.

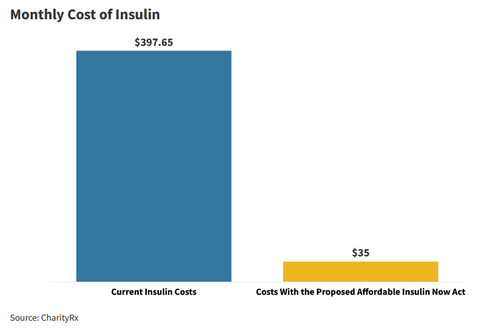

According to CharityRX, the new legislation would carry a potential cost savings of 91% by capping insulin costs at $35, or 25% of a health insurance plan’s negotiated price – whichever is less.

The survey comes as a bipartisan group of Senators are working on legislation that would cap the cost of insulin, after President Biden reversed a Trump-era measure designed to lower out-of-pocket insulin costs for seniors on Medicare.

E-Course: Conquer Sugar, Manage Diabetes and More (Ad)

More via CharityRX;

The exorbitant pricing of insulin in the U.S. has forced many diabetics and their caregivers to make difficult decisions and compromises that put their health and/or livelihood at risk. Of the 4 in 5 who’ve struggled financially due to insulin pricing:

- 83% say they’ve feared not being able to pay for living expenses due to high insulin costs, cutting expenses such as clothing (55%), food costs (50%) and for some, even rent/mortgage (29%)

- 63% have felt pressure to sell prized, personal possessions (63%), put themselves in risky situations (50%) or to sell prescriptions or illicit drugs (32%) in order to obtain the money needed for insulin

- In an effort to lower costs, 62% have skipped and/or adjusted the dosage of insulin injections for themselves, or as a caregiver for someone else to cut down on costs

- Of those who’ve rationed their insulin, diabetics have experienced the following negative impacts on their day to day life:

- Inability to do everyday activities (54%)

- Inability to work (44%)

- Admission to the hospital for one or more days (38%)

- Inability to attend school (37%)

- Further, 38% have been admitted to the hospital for more than one day and 33% have become sick with an additional health issue as a result of insulin rationing

Source: ZeroHedge